The real winners at auction last week? The collectors who managed to hold on to their paintings, resisting the urge to sell during the recession. Despite every economic indicator that hard assets, such as collectibles, were going down in value, first-rate pictures by classic names held up better than expected. However, New York Times auction reporter Carol Vogel wrote that there was no reason to celebrate because the total gross sales were so much lower than those of May 2008 -- partially missing the point. Dollar volume may have been down due to lower prices, fewer lots and a pronounced absence of mega-lots. But the art that did appear sold and found its level, setting a floor for prices to eventually recover.

If you exclude works by Alexander Calder, prices in general feel like they’ve receded 33 percent from their high water mark in London in June 2007 -- a far cry from the 66 percent drop during the hellish market demise of 1990-93. While the recovery may be slow, and prices may remain at their current level for the next few years, who cares? The numbers are high enough. Besides, it allows those who have been standing on the sidelines to get back into the game. Maybe even new buyers will be attracted because the art market has stabilized.

That having been said, let’s examine some of the individual artists who fared well at the May auctions, and a few who didn’t. Remember, the real test of any market is what happens when times are difficult. Whoever retains the most value in a down market will exponentially go up the most when things improve. Conversely, the same holds true for artists who depreciate the most during a recession.

WINNERS

Cecily Brown:

When Brown’s triptych Girls Eating Birds exceeded its estimate during a mediocre sale at Sotheby’s on May 12, 2009, it only reinforced her position as a “money artist.” I’ve said it before, and I’ll say it again: Brown can flat-out paint. Her hide-and-seek figures are more than mere armatures to hang paint on -- they create a compelling narrative about relationships. Given her youth (she’s still improving), strong gallery representation (Gagosian) and consistency on the resale market, I’d be hard-pressed to find a more reliable bet.

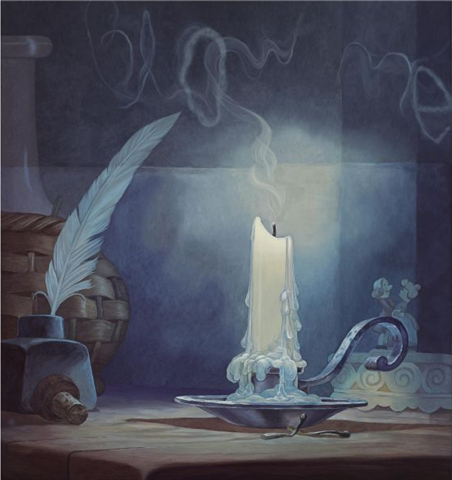

Dan Colen:

Though still unproven at auction over time, Colen is one of a handful of really young artists who might have some staying power. Witness the number of youthful dealers, as reported by the press, who pursued the unfortunately titled Untitled (Blow Me) at Sotheby’s on May 12. A seasoned collector should always be aware of what the next generation of dealers are supporting at auction. Colen is a good example.

Alexander Calder:

The winner and still champion. When times get tough, the tough go shopping and buy Calder. During the 1990s recession, Calder’s prices probably held up the best. This time around, Calder exceeded expectations, creating some very happy consignors. It may be a simplistic statement, but his work appeals to all ages and levels of sophistication. Early Calders, which incorporate wooden elements, always sparkle at auction -- as was the case yet again in this week’s sales.

Richard Diebenkorn:

Ocean Park No. 117 represented the “perfect Diebenkorn” from his most desired series. This painting has it all: color, structure and, most important, apartment-size scale. The market responded accordingly with a huge price ($6.5 million). Diebenkorn’s work continues to look better over time. Once European collectors and curators get over their prejudice (they accuse him of being overly influenced by Matisse), and view him more as an American who absorbed Matisse, look out.

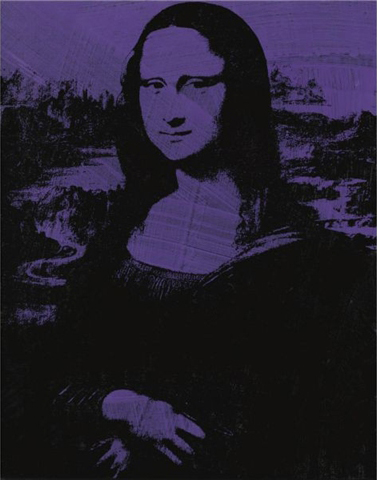

Andy Warhol:

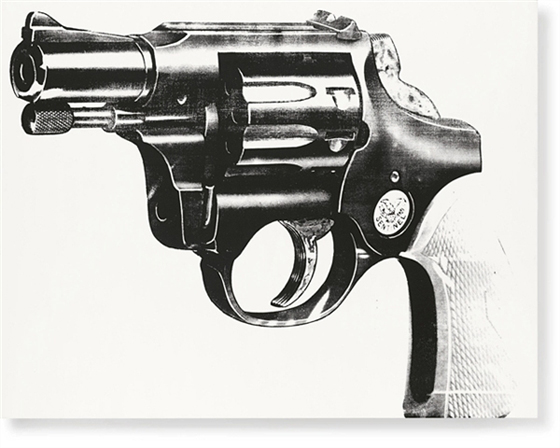

Surprise. Though Warhol’s prices have dipped with the rest of the market, his work did well during this round of sales, despite the lack of a single star-quality painting.

Even though some of the estimates proved aggressive, others, like that assigned to the large Gun -- estimated at $2,200,000-$2,800,000, and sold for $3,106,500 with premium -- confirmed the auction houses’ confidence. As the most widely collected artist, Warhol continues to be the most accurate market gauge, when it comes to judging the overall health of the art business. If I were a doctor, who had just taken the market’s temperature based on Warhol’s recent prices, I would say, “The patient is resting comfortably.”

LOSERS

Frank Stella:

I don’t get it. Just when Stella appears to be ripe for a comeback, the art market pulls the proverbial rug out from under him. It’s hard to understand why prime 1960s pictures, such as Double Mitered Maze (est. $1,200,000-$1,800,000) continue to be bought-in. It seems like the Stella market never recovered from the artist’s much-derided second retrospective at MoMA in 1987. Stella’s work from the late 1950s through the 1970s remains beautiful and significant. It deserves a better fate.

Damien Hirst:

The world’s most successful living artist is cited here for lack of participation. You would think with $200 million worth of his work sold only seven months ago, there would be plenty of sellers looking to cash in. Certainly, you would expect at least one major Hirst to appear between the two major houses. Instead, there were only “day sale” quality Hirsts and not a single million-dollar lot. What happened? While we haven’t heard the last from the artist, you sense that his market may have overreached and burnt itself out. At least for now.

Robert Gober:

It was not a good week for Robert Gober, who saw two major sculptures not sell. Sotheby’s Untitled (a male butt with musical notes) was one of the best Gobers ever to appear at auction. Unfortunately, it carried an estimate of $2,500,000-$3,500,000 -- an estimate that was a year old. Had the owner lowered his expectations by a million dollars, the work probably would have sold. Over at Phillip’s, another Untitled work -- a replica of a box of Farina with an open-mouthed young boy on the front -- carried the same estimate and experienced the same results -- proving how little control an artist has over the perception of his market. No matter, Gober will bounce back.

Chinese Art:

While it’s always dangerous to lump together all the artists from an entire country (not to mention the most populous country in the world), in this case it’s apropos. The few Chinese pictures to grace the evening sales did only so-so -- gone were the speculators who drove this market. Those who participated at the beginning, and sold relatively early, cleaned up (with a new market it’s always better to go second than first). While it’s wonderful that the political climate in China relaxed enough to allow freedom of expression, the art it produced was completely derivative of Western painting. There is nothing innovative or original about Chinese contemporary art. This market will continue to fade.