Exhibit A: The biggest issue facing the art business is that no one knows what anything is worth. Yet everyone I talk to seems to know exactly what their property is worth -- it’s still worth what it was before the crash!

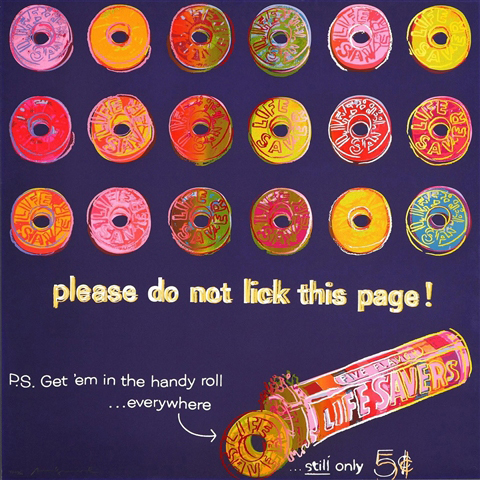

The other day, I had a request from a collector who wanted a commercial yet attractive Andy Warhol print -- Turtle (1985), more commonly called Sea Turtle. With that in mind, I placed a call to an equally commercial gallery in Los Angeles, who boasts one of this country’s largest inventories of Warhol prints. A brief conversation with the director revealed that yes, in fact, they did have a Sea Turtle silkscreen for sale. I was told they wanted a net of $16,000.

I responded, "Sounds like the old price."

The gallery director said, "It is."

We then went on to have an asinine conversation about how his gallery bought the print at the height of the market, for $16,000, and he refused to take a loss. Ditto for much of the rest of his inventory. I countered, "How do you expect me to pay a former retail price, when the market might be down 50 percent?" The gallery director’s rebuttal? Something to the effect of, "It’s up to you if you want to pay it or not."

I said, "Maybe my thinking is flawed, but I don’t want to pay twice what something might be worth. Assuming there are others who think like me, how do you expect to make a living?"

At this point, the discussion took off into the ozone. The director said, "We’ve been offering to buy A+ paintings from clients who are desperate for cash. But, of course, we expect to pay very little. That way, we can pass along good deals to our clients who are still buying."

I said to him, "Let me try and put this into perspective. You want me and my client to overpay for inventory that you overpaid for. Yet you personally want to be able to buy at the new heavily discounted prices -- probably from the same people you sold the work to originally at the former high prices?"

There was silence in Los Angeles.

Unfortunately, most of what I’ve been hearing has been only a slight variation of the above "pretzel logic." It’s kind of like someone who has their home on the market and refuses to adjust his price to the new reality. The seller has an emotional attachment to his property, leading him to believe that his home is different. It hasn’t gone down in value because it’s such a beautiful house, while his neighbors’ homes have declined in price because they’re not as nice as his.

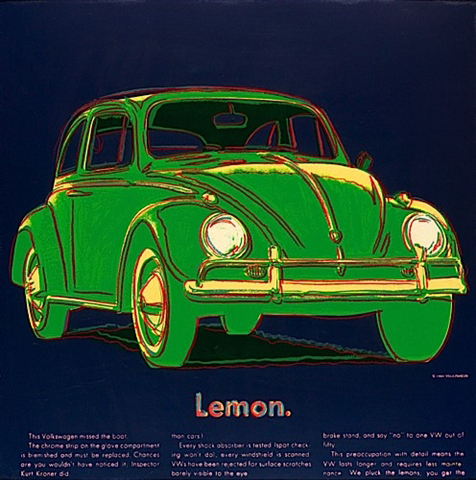

Exhibit B: The second biggest issue facing the art market is lying. That is to say, dealers who lie about what they paid for something. This is exactly what I experienced the other day when I went searching for a very specific painting from Warhol’s late "Advertising" series. While scanning Artnet’s 53 pages of Warhol listings, I was actually able to track down the very painting my client wanted. Within minutes of sending an inquiry to the dealer offering it, I received the following response, "We paid $200,000 for the picture but are willing to accept $140,000."

On the surface, this seemed like a magnanimous offer. Here was a colleague that I never met, sharing the cost of his inventory with me, as if we were lifelong partners. The implied message was look how open and honest I am. Now, I suppose this person could be telling the truth. But I doubt it. If we agree that the art market’s current demise began with the November 2008 New York auctions, then we are only three months into the industry’s recession. I found it difficult to believe that someone was willing lose $60,000 this quickly. Sure, they might be desperate. But the problem with that theory is that if they were really starved for cash, they would have to be more realistic and price the painting at its current fair market value: under $100,000. While the aforementioned "Exhibit A" anecdote represents one extreme position ("I won’t take a loss"), here’s the other end of the spectrum.

With the May auctions less than three months away, now is the time for dealers to be honest with themselves. If they have any real hope of selling their inventory, they need to cut out the rhetoric. If you believe that the auction house strategy this spring is going to be smaller sales, rock bottom estimates, and a "sell it at any price -- but sell it!" mentality, you have to beat the auctions at their own game. If you’re a collector, you need to go to the dealer and make an offer based on what you think the painting will be worth once the May sales conclude. If you’re a dealer, you need to price your inventory the same way. Or you can you expect the end results from Exhibits A & B -- neither dealer made a sale.