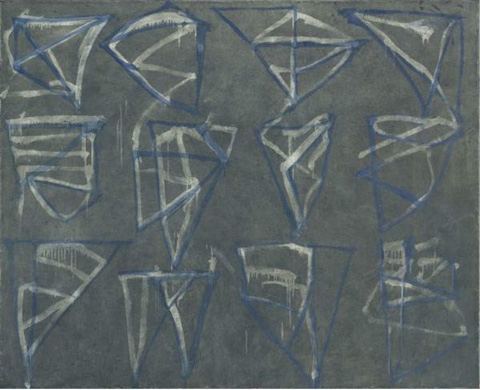

1) Buy a mediocre painting instead of a great print. Or for that matter buy a mediocre painting rather than a great drawing. Too often collectors get caught up in art’s snob appeal. The objective is always to buy the best within your budget, regardless of medium. As wonderful a draughtsman as Jasper Johns is, not all of his drawings are up to snuff. It’s much better, from an investment standpoint, to buy one of his great prints, such as Ale Cans. There’s no doubt that it will appreciate at a faster rate than one of Johns’ murky ink-on-vellum drawings.

2) Let the auction houses talk down your reserve. From the auction house’s perspective, it’s all about convincing consignors to accept the lowest reserve possible. If, for instance, you put a painting up for auction and agree to a presale estimate of $600,000-$800,000, and a reserve of $600,000, you can expect a call a few days before the sale that will go something like this: "Look, we think your picture will do well, but given the economy, let’s be on the safe side and lower the reserve to $500,000."

Don’t do it. If your painting passes at $600,000, the auction house will field offers for it after the sale. Chances are the bidding stalled at $550,000, which means a potential after-sale buyer is likely to offer $500,000 (or less). If your reserve is already down to $500,000, you’ll probably be offered $400,000 (or less). The bottom line is that if you have a good painting, someone will pay up. If not, you shouldn’t have put it up for auction in the first place.

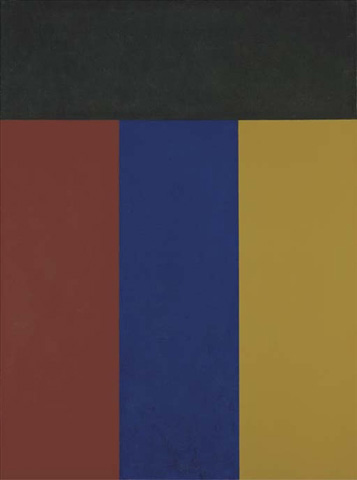

3) Accept a mere 10 percent discount from a gallery. For the purchase of works by contemporary art gods such as Brice Marden, Ellsworth Kelly and a handful of others, a buyer would be lucky to receive a 10 percent discount on any purchase from their galleries. But superstars aside, accepting a standard 10 percent off on even a successful mid-career artist is a mistake.

Galleries generally work on a 50-50 split with artists they represent. This means you should be able to get at least 20 percent off with a little negotiating. Right now, not only are galleries hurting, but so are their artists, who got used to flush times. From a dealer’s perspective, few things are worse than having an artist bug him or her for money. If for no other reason than that, galleries are likely to accept your 20 percent discount request. Try it.

4) Buy with your ears rather than your eyes. Here’s a great way to be taken to the cleaners. I’ll never forget the time the Los Angeles painter Chuck Arnoldi told me how he was at a party when Eli Broad, the country’s richest collector, came over to say hello and ended their discussion by saying, "See you at your studio."

The merely rich collector Douglas Cramer overheard this snippet of conversation and immediately approached Arnoldi requesting to do the same. In this case, Arnoldi was merciful enough to tell Cramer that "nothing was afoot with his career," after which Cramer promptly canceled his studio visit. You get the idea.

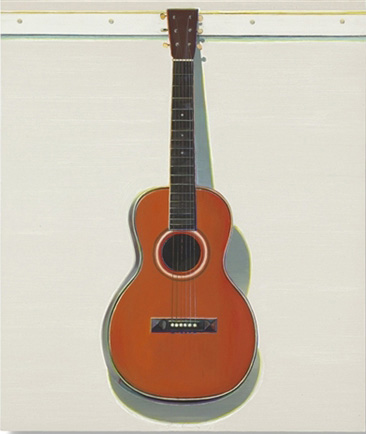

5) Buy an atypical work. Another sucker bet. There always seems to be one artwork in any given show where the subject matter veers off into the ozone. If you’re buying a Wayne Thiebaud, you obviously want to buy "sugar." Even though Thiebaud is a first-rate portrait painter, the art market could care less.

No matter how tempting one of his figurative paintings may be, or how attractive its price, treat it like drugs and just say "no." You may even decide that you genuinely like the painting regardless of market forces. But if you acquire it, when the time comes to sell, you will come to despise your "inspired" purchase when you see how difficult it is to unload at any price.

6) Buy a work from a blue-chip gallery without being properly introduced. I once dealt with a wannabe collector named Paul S. who always bragged to me about his buying trips to New York. He waxed poetic about how "Ileana" (Sonnabend) rolled out the red carpet for him and how fortunate he was to buy a Peter Halley from her.

The only problem was that it was a weak painting that had already been rejected by Sonnabend’s better customers. The point of the story is that if you want to play with the big boys (Gagosian, PaceWildenstein, Marks, etc.), you had better be damn sure that one of their top collectors recommends you. Otherwise, you’ll receive the "Paul S." treatment.

7) Buy a work by an artist who’s "in play." If you decide that you want to buy a Richard Prince "Nurse" painting, you might as well put your money into California boutique wine futures and watch them go down — at least you can drink the wine. Richard Prince "Nurses," originally offered at Gladstone in the mid-2000s, for around $85,000 to members of the "club," climbed to over $8 million in 2007 (they’ve since dropped back to under $3 million).

Regardless, the speculator gang that ran up his prices at auction are like an elite fraternity house that you can’t join because you aren’t cool enough (in this case substitute "rich enough") -- so don’t even bother trying. Now that Prince has run his course, the next artist "in play" appears to be Peter Doig. Ditto for staying away from his work and market. Better to be an independent thinker and put your money into an artist who’s poised for slow and steady growth -- like Fred Tomaselli, Philip Taaffe or Christopher Brown.

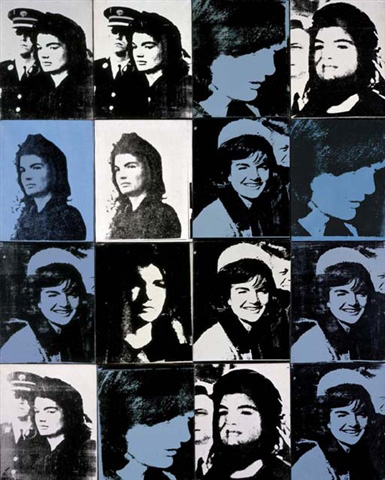

8) Buy a work right after an artist has died. One of the biggest myths in the art market is that an artist’s work shoots up in value right after his or her death. Wrong (with the exception of Warhol). Most actually go down in value. The reason is that his market usually becomes flooded, thanks to family members struggling to pay estate taxes and dealers and collectors looking to cash in. Better to wait a year or two and let the dust settle, even if you end up having to pay a bit more.

9) Buy works of unusually large scale. The late Los Angeles dealer Paul Kanter once told me, "Never buy a painting that you can’t lift." He was right. There’s nothing harder to resell than a painting that’s larger than eight feet in any dimension. Even seven feet is cutting it close. Oversize paintings become white elephants in the marketplace.

Only a small pool of potential buyers have the wall space to handle these often ego-driven paintings. If you have a substantial wall that cries out for a massive work that makes a statement, you’re better off buying two smaller works to fill the void.